Pkf Advisory Llc Fundamentals Explained

Pkf Advisory Llc Fundamentals Explained

Blog Article

Fascination About Pkf Advisory Llc

Table of ContentsHow Pkf Advisory Llc can Save You Time, Stress, and Money.4 Easy Facts About Pkf Advisory Llc ShownThe Buzz on Pkf Advisory LlcThings about Pkf Advisory LlcIndicators on Pkf Advisory Llc You Need To Know

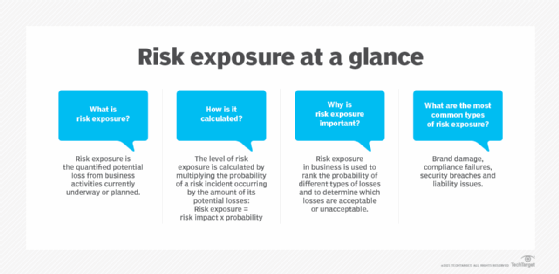

Centri Consulting Risk is an unavoidable component of operating, however it can be managed through comprehensive assessment and management. The bulk of interior and outside risks firms deal with can be resolved and minimized through danger advisory finest techniques. But it can be difficult to measure your risk direct exposure and use that details to position on your own for success.This blog is created to assist you make the appropriate option by answering the concern "why is threat consultatory important for organizations?" We'll additionally evaluate internal controls and discover their interconnected connection with organization threat monitoring. Just placed, company dangers are preventable interior (tactical) or exterior hazards that affect whether you attain your organizational goals.

Every company should have a solid danger monitoring strategy that information current risk levels and how to reduce worst-case scenarios. Among one of the most essential threat advising finest methods is striking an equilibrium in between protecting your organization while also assisting in continuous growth. This calls for executing international approaches and administration, like Committee of Funding Organizations of the Treadway Commission (COSO) internal controls and venture danger management.

The Buzz on Pkf Advisory Llc

Among the most effective ways to take care of risk in service is with quantitative evaluation, which uses simulations or statistics to appoint risks certain numerical worths. These assumed worths are fed into a threat model, which creates a variety of outcomes. The outcomes are examined by risk supervisors, who make use of the data to recognize company possibilities and minimize unfavorable end results.

These records likewise include an assessment of the effect of adverse end results and reduction plans if damaging occasions do occur - pre-acquisition risk assessment. Qualitative threat devices include reason and effect layouts, SWOT evaluations, and choice matrices.

With the 3LOD design, your board of supervisors is accountable for danger oversight, while elderly management establishes a business-wide risk culture. Liable for possessing and minimizing threats, operational supervisors oversee everyday organization transactions.

The Pkf Advisory Llc Statements

These jobs are usually handled by economic basics controllership, quality assurance groups, and compliance, that might also have obligations within the very first line of defense. Internal auditors give neutral guarantee to the initial two lines of defense to ensure that dangers are handled appropriately while still meeting operational objectives. Third-line employees should have a direct relationship with the board of supervisors, while still maintaining a link with administration in economic and/or lawful abilities.

A detailed collection of internal controls ought to consist of things like settlement, paperwork, protection, permission, and separation of responsibilities. As the number of ethics-focused financiers proceeds to boost, many businesses are adding environmental, social, and administration (ESG) standards to their inner controls. Financiers make use of these to figure out whether a company's worths line up with their own.

Social criteria analyze exactly how a company manages its relationships with employees, clients, and the bigger area. Governance standards analyze a business's management, internal controls, audits, investor legal rights, and executive pay. Strong internal controls are necessary to company threat monitoring and considerably increase the likelihood that you'll attain your goals. They likewise increase performance and improve conformity while streamlining procedures and helping stop fraud.

The Greatest Guide To Pkf Advisory Llc

Developing an extensive collection of inner controls entails approach positioning, systematizing plans and treatments, process paperwork, and establishing functions and duties. Your internal controls need to include risk advisory ideal methods while constantly remaining concentrated on your core service purposes. The most efficient internal controls are tactically segregated to prevent potential problems and decrease the risk of monetary fraudulence.

Producing excellent interior controls involves implementing rules that are both preventative and investigative. They consist of: Restricting physical access to devices, inventory, and cash money Separation of tasks Authorization of invoices Confirmation of expenditures These backup procedures are developed to spot unfavorable results and threats missed by the initial line of protection.

You'll also find information about SOC 1, which is a particular sort of external audit. Internal audits involve a complete analysis of an organization's inner controls, including its accounting techniques and corporate administration. They're developed to make certain governing conformity, together with exact and timely economic coverage. Internal audits also assist preserve optimal effectiveness by revealing and remedying concerns prior to business undertake external audits.

Pkf Advisory Llc Can Be Fun For Anyone

According to this regulations, administration teams are legally responsible for the accuracy of their firm's monetary declarations - cybersecurity consultants. Along with securing investors, SOX (and internal audit assistance) have dramatically boosted the integrity of public accounting disclosures. These audits are carried out by objective 3rd parties and are designed to review a business's bookkeeping treatments and inner controls

Report this page